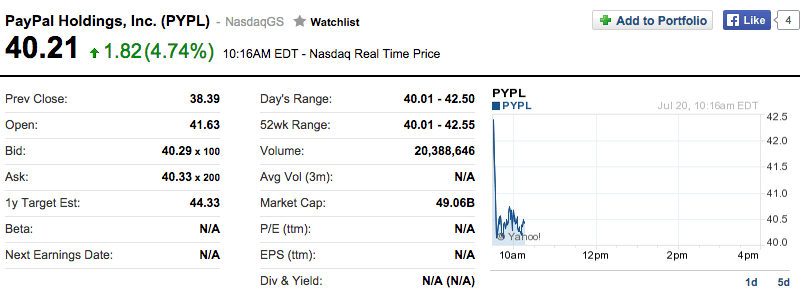

Everybody expected PayPal (NASDAQ:PYPL) to be worth more than eBay following its split with its parent company (NASDAQ:EBAY), but not that much. After a short period of trading on a “when issued” basis, PayPal is now officially an independent company. On its first day of trading, shares opened at $41.63, 8.3 percent above Friday’s last temporary closing price before its public introduction.

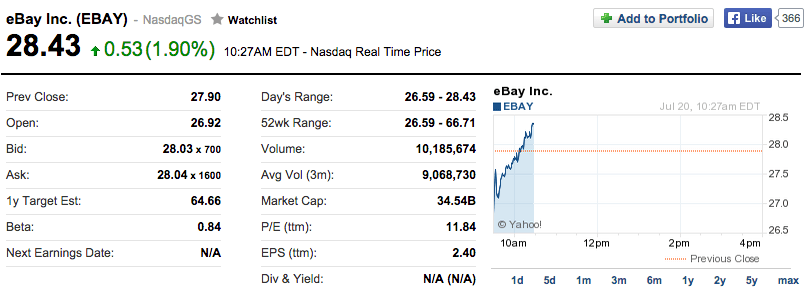

With shares trading at $41.63, it values the company at $50.8 billion, above eBay’s current intraday valuation of $34.5 billion. PayPal shares are now trading at $40.21 minutes after NASDAQ’s opening bell. Shares are still up 4.74 percent even with this small market correction.

As a reminder, shortly after PayPal’s first IPO, the company was acquired by eBay in July 2002 for $1.5 billion. The same company is now worth 33 times its last public valuation. Until now, PayPal has managed more than 18 billion transactions and over $1 trillion. It now has 169 million consumers in 200 countries.

In other words, PayPal is no longer the shiny new fintech startup. It’s a full-fledged finance heavyweight, ready to report quarterly earnings again. It faces competition from local giants, such as Alibaba’s Alipay, and newcomers, such as Stripe.

Today’s split is great news for the payment company, as it will give it more freedom to raise additional capital and acquire other companies. Now that PayPal is no longer just an eBay subsidiary, shareholders clearly demonstrate that they want to hold shares in PayPal, not eBay.

Moreover, PayPal’s executives can now issue bonds without going through eBay. It can also acquire companies using PayPal stock and more. It’s going to be an interesting new journey for PayPal.

Comments

Post a Comment