Long before Apple Pay, big brick-and-mortar retail chains were conspiring to sidestep the typical 2% to 3% fees they’re charged by credit card companies when consumers pay with credit. A company called MCX (Merchant Customer Exchange), spearheaded by Walmart, was started to build a mobile payment solution that would become an app called CurrentC that’s preparing to launch, but is already in the app stores.

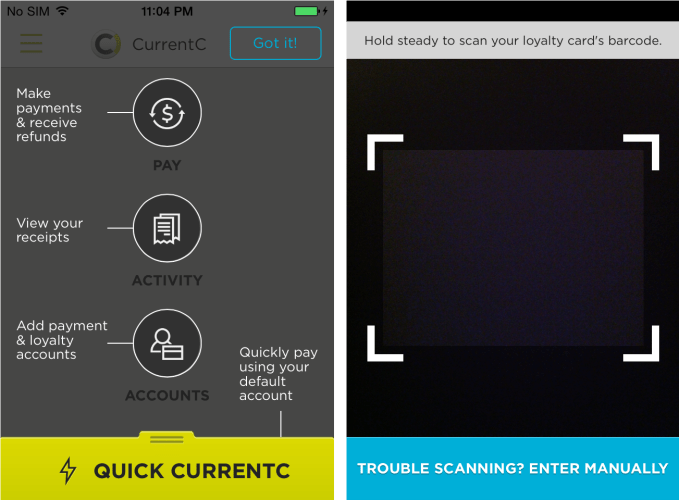

Rather than NFC, CurrentC uses QR codes displayed on a cashier’s screen and scanned by the consumer’s phone or vice versa to initiate and verify the transaction. The system is also designed to automatically apply discounts, use loyalty programs, and charge purchases to a variety of payment methods without passing sensitive financial data to the merchant.

Retailers including CVS and Rite-Aid were planned partners for CurrentC. Now those businesses have pulled unofficial support for Apple Pay through their existing NFC readers, according to a report from MacRumors and a memo obtained by SlashGear. This implies they’ve established exclusive deals with MCX to use CurrentC as their mobile payment option.

Thanks to research shared with TechCrunch by Stanford student and developer sleuth Andrew Aude, we have more details on MCX’s plan and a closer look at the CurrentC app.

A Multi-Year Plot To Ditch Credit Card Fees

Originally incorporated in 2011, MCX spent years in a sort of stealth mode working on the payments user experience. The company is run by merchants including Walmart, Target, Best Buy, CVS, Shell Oil, Darden Restaurants (Olive Garden), HMSHost (airport restaurants), Hy-Vee (supermarkets), Lowes, Michaels, Publix Super Markets and Sears. Wal-Mart VP and Assistant Treasurer Mike Cook is considered the MCX group’s de facto CEO, with some joking that MCX stands for Mike Cook Exchange, as FierceRetail reported.

Together, the companies operate over 110,000 retail locations and process over $1 trillion in payments annually, with a significant chunk coming in the form of credit card payments that cost the retailers fees.

Walmart has long voiced its disdain for credit card processing fees that drain its slim margins, and even filed an anti-trust lawsuit against Visa and MasterCard over them back in 2003, but rejected the settlement they offered because it wanted more.

The idea behind MCX was that if enough retailers teamed up, they could convince consumers to adopt their mobile payment system that would let retailers avoid paying credit card fees in the 2 percent to 3 percent range by processing payments through Automatic Clearing House transactions through bank accounts that have much smaller fees. MCX’s app could also help retailers by encouraging loyalty to participating merchants and possibly provide them additional intelligence on their customers.

If MCX’s app caught on, partner retailers could escape tons of fees, which could directly increase their profits. Alternatively, they could use the leverage of MCX and the threat of sidestepping the processing fees to negotiate lower fees with the credit card companies. Former Walmart CEO Lee Scott reportedly once said “I don’t know that MCX will succeed, and I don’t care. As long as Visa suffers.”